Total Costs in The Brazilian Efficiency Model of Distribution System Operators: An Analysis - Juniper Publishers

Juniper Publishers - Open Access Journal of Engineering Technology

Abstract

This study analyses the efficiency of electricity

distributors in Brazil by considering total costs. The impact of the

inclusion of total costs is evaluated with four different efficiency

models using Data Envelopment Analysis and Stochastic Frontier Analysis.

The analyses are conducted using a sample of 60 companies over two

periods of time. The years 2008 to 2010 are used to calculate the

efficiency frontier, and the years 2011 to 2012 are used to validate the

methodology. The results show that, on average, the total costs

estimated by benchmarking methods are approximately 7% lower than those

observed in 2011 and 2012, that is, utilities need to reduce their total

annual costs by approximately R$40 million on average.

Keywords: Efficiency;

Electricity distributors; Methodologies; Electricity sector;

Competitive; Environment; Incentive regulations; Operating costs;

Distribution system operators; Territorial extension; Efficiency scores;

Environmental variables; Tariff reviews; Remuneration; Minor components

costsAbbrevations: DSOs: Distribution System Operators; CR: Capital Remuneration; RD: Regulatory Depreciation; MC: Minor Components Costs; AC: Additional Costs; DEA: Data Envelopment Analysis; CRS: Constant Returns to Scale; VRS: Variable Returns to Scale

Introduction

Since 1990, number of infrastructure sectors around

the world, including the electricity sector, have initiated long reform

processes, replacing rate of return regulation with incentive

regulation. Although the structures and methodologies adopted by the

electricity sector have changed since the reforms, the main objective of

efficiency improvement has been maintained [1].

Rate of return regulation, which was widely used

before the reform process, had an adverse effect. Specifically, it

encouraged companies to overinvest to obtain greater capital

remuneration. This effect is known in the literature as the

Averch-Johnson effect [2]. In this scenario, consumers are penalized by

having to pay high tariffs.

Following the reform process, incentive regulation

has become popular in the electricity transmission and distribution

segments because it incentivizes companies to become more efficient [3].

Under this type of regulation, benchmarking techniques are applied to

detect inefficiencies during the electricity transport process. In

short, these techniques aim to compare similar companies in a

competitive environment [4].

In Brazil, rate of return regulation is partially

employed in the definition of capital costs, whereas incentive

regulation is fully applied in the calculation of operating costs.

However, economic

regulation best practices follow a different trend: the adoption of

incentive regulation for capital and operating costs. This practice is

based on the existence of a potential trade-off between the two costs

[1]. If they partially adopt rate of return regulations for capital

costs and incentive regulations for operating costs, companies will

simultaneously seek to raise the former and reduce the latter [5].

In this context, the present study proposes the use

of total costs for the efficiency analysis of Brazilian distribution

system operators (DSOs) from an incentive regulation perspective.

Several studies analyzing the efficiency of Brazilian

DSOs have been published, but, to the best of our knowledge, no study

has evaluated the economic effect of the adoption of total costs in the

efficiency model. Xavier, Lima, Lima, and Lopes [6] propose an

alternative form of efficiency analysis for Brazilian DSOs motivated by

the great territorial extension. Despite the use of total costs with

physical variables as a proxy, their study does not analyses the

economic impact. Costa, Lopes, and Matos [7] evaluate operating cost

models proposed by Brazilian regulators and discuss their main

inconsistencies. Corton, Zimmermann, and Phillips [8] investigate the

effect of incentive regulation on the operating costs of Brazilian DSOs,

focusing on service quality. Altoé, Júnior, Lopes, Veloso, and Saurin

[9] analyse the relationship between technical efficiency and some

financial variables related to capital management using operating costs,

costs related to service quality, and non-technical losses. Gil,

Costa, Lopes, and Mayrink [10] examine the statistical correlation

between efficiency scores and environmental variables using

operating costs as inputs.

Despite the previous research, studies that investigate

the incentive regulation effects on the total costs of Brazilian

electricity distributors are still necessary. At the moment, this

proposal is subject to an internal study by Brazilian regulator.

However, given the global trend, a shift towards total costs will

become essential. Thus, this study provides empirical evidence

of the impact of adopting total costs on efficiency analysis by

comparing four different models.

Brazilian Electricity Distribution Regulation

Since 2003, DSOs have been regulated by a price cap model,

which specifies an average rate under which tariffs should

be adjusted considering inflation and productivity targets (X

factor). The electricity distribution segment has completed three

tariff reviews (2003-2006, 2007-2010, and 2011-2014) and

is completing the fourth (2015-2018). During a tariff review,

capital and operating costs are redefined.

Capital Costs

Capital costs consist of capital remuneration (CR) and

regulatory depreciation (RD). CR is the product of the

remuneration rate and the net remuneration base, which

corresponds to recognised investments and is not depreciated.

RD is the product of the average depreciation rate and the gross

remuneration base, which corresponds to total recognised

investments.

In the fourth tariff review, the previous asset base was

maintained and updated by the inflation index. New assets were

valued according to the concept of the optimised and depreciated

replacement cost, and a utilization index was applied to all

accepted assets to reduce overinvestment.

A reference price base is used to calculate the average minor

components costs (MC) and additional costs (AC), which make

up the final fixed asset value (replacement new value-RNV),

according to Equation 1:

RNV=ME+MC+AC (1)

Where:

ME-main equipment, such as circuit breakers and current

transformers;

MC-fixed components associated with a particular

constructional standard, such as control cables and insulators;

AC-setting up the good, consisting of design, management,

assembly, and freight costs.

ME is valued according to the company’s price base, whereas

MC and AD are valued according to the reference price base,

which has created an incentive mechanism within capital costs.

The reference price base is structured in a modular way such

that a module is associated with each type of ME according to the

company’s group. The regulator applies a clustering technique to

segregate 63 DSOs into five groups to take into account different

levels of investment in electricity distribution systems. Each

company has an average group cost considering differences

between the concession areas. Once the prices of the ME, MC,

and AC are known, the RNV is calculated.

Operating Costs

The Brazilian regulator applies Data Envelopment Analysis

(DEA) as an efficiency analysis, with operating costs as an

input. The outputs are the underground network, the over

ground network, the high-voltage network, distributed energy,

the number of consumers, non-technical losses, and service

quality. The sample has 61 DSOs, with mean values for the

variables during 2011, 2012, and 2013. The analysis preserves

non-decreasing returns to scale and the input orientation. The

regulator creates a confidence interval around efficiency scores

because DEA has a deterministic aspect.

From these restrictions, an operating cost target is set to

be reached over the regulatory period. At the time of review,

the target is compared to real operating costs. The difference

between real and target costs determines a regulatory trajectory.

Part of the difference is incorporated at review time, and the

remaining portion is considered in X Factor [11].

International Electricity Distribution Regulation

Unlike in the early years of reform, when regulators were

worried about operating costs, a current emerging question is

how to ensure that utilities set efficient investment levels. Over

the years, DSOs have improved their performances in response

to incentive regulations. However, significant investment is

needed over the next few years, and this need, combined with

incentives to reduce costs, accentuates a new challenge between

efficiency and investment [12].

This broad view of total costs has several motivations,

including the trade-off between operating and capital costs, the

freedom of companies to choose different strategies, and the

trade-off between cost efficiency and quality.

An analysis that segregates operating, and capital costs

encourages substitution between these cost categories [13].

Consider a benchmarking model in which operating costs are

the only input and the distribution network is the only output.

Utilities will increase investments by focusing on maximizing

output and the return to capital, resulting in greater operational

efficiency; however, tariffs will increase.

Companies can adopt different combinations of operating

and capital costs to operate and improve their networks [1].

When total costs are considered, a DSO is free to choose an

optimal cost composition.

In addition, total costs play an important role in service

quality analysis. As more DSOs invest in network reliability, total

costs and quality improvement marginal costs will be higher.

Therefore, a total cost model is more appropriate to evaluate this

possible trade-off [14].

Finally, a total cost model is considered one of the best

regulatory practices, according to Haney and Pollitt [15]. A similar

result is presented by Mesquita [16], who investigates aspects

of the efficiency analyses currently employed by European and

Latin American countries. The analysis considers ten European

countries and eight Latin American countries and finds that most

of the countries surveyed use total costs.

However, adopting total costs in efficiency models can

also mean a strong incentive to reduce capital costs and may

jeopardize long-term investments [17]. The possible adverse

effect of discouraging investment and jeopardizing the future

performance of energy distribution networks has been pointed

out as one of the possible causes for the non-adoption of

total costs by the Brazilian regulator. However, the regulator

recognizes its use as an international trend:

‘Discussions like this point toward benchmark model based

on total cost, which has been a trend in international regulatory

experience. However, a breakthrough in this direction requires

a much deeper study and certainly a space for methodological

transition and adaptation of agents’ [18].

This adverse effect is not observed by Cullmann & Nieswand

[19] when analyzing incentive regulation effects on the

investment behavior of 109 German DSOs. The results show an

increase in investments from 2009 for both public and private

companies. The authors conclude that an analysis of investment

decisions should include all institutional aspects of incentive

regulation.

From a similar perspective, Poudineh & Jamasb [20] explore

the determinants of the investment decisions of 129 Norwegian

DSOs in the period from 2004 to 2010. The results show that the

main factors influencing these decisions are the rate of return

under the previous period’s investment, socio-economic costs,

and the lifespan of useful assets.

Cambini, Fumagalli, & Rondi [21] investigate the relationship

between incentives, service quality, and the investment levels

of Italian DSOs. The results indicate a causal relationship

between incentives and investment levels, and, in the process

of performance improvement, penalties are more effective than

rewards are.

Benchmarking Methods

The most recent advances in the field of efficiency,

microeconomics, and econometrics studies are focused on

efficiency frontier analysis. Given the impossibility of observing

theoretical efficiency frontiers, efficiency is determined by

empirical boundaries, estimated by observing the minimum use

of inputs given an output level or the maximum output given an

input level. This study uses DEA and Stochastic Frontier Analysis

(SFA) in estimating the efficiency of Brazilian DSOs.

Data Envelopment Analysis

DEA is a nonparametric methodology that uses real data

to measure the relative efficiency of a DMU. It was proposed

by Charnes, Cooper & Rhodes [22] to address the efficiencies

of companies operating in constant returns to scale (CRS) and

further extended by Banker, Charnes & Cooper [23] to variable

returns to scale (VRS).

This efficiency analysis can be focused on input reduction or

output expansion. The result from an input-oriented model is the

maximum reduction possible in the inputs level for a given level

of output. With an output-oriented focus, the model seeks the

maximum output quantities that can be generated by the actual

level of inputs used by the company. The efficiency scores can

vary from 0 to 1, where 1 denotes the efficient company

The majority of the DEA models consider either CRS or VRS.

For CRS model, outputs and inputs increase (or decrease) by

the same proportion along the frontier. Where the technology

exhibits increasing, constant or decreasing returns to scale along

different segments of the frontier, the VRS model is indicated.

The CRS model assesses the overall technical and scale efficiency,

while a VRS model measures only the technical efficiency.

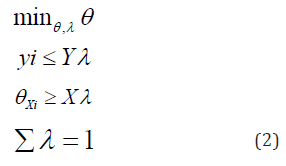

The efficiency score of the ith company of N companies in

CRS models takes the form specified in Equation 2, where θ

is a scalar (equal to the efficiency score) and λ is a Nx1 vector

that represents the weight of each Decision-Making Unit in

the construction of the reference company. Assuming that the

companies use E inputs and M outputs, X and Y represent ExN

input and MxN output matrices, respectively. The input and

output column vectors for the ith company are represented by

xi and yi respectively. In Equation 2, company i is compared to a

linear combination of sample companies which produce at least

as much of each output with the minimum possible amount of

inputs. The Equation 2 is solved once for each company.

For VRS models, a convexity constraint Σλ = 1 is added that

ensures that the company is compared against other companies

of a similar size.

Stochastic Frontier Analysis

SFA, a parametric method, was originally developed by

Aigner, Lovell, and Schmidt [24] and Meeusen and Broeck [25]

and allows the estimation of the inefficiency associated with a

production function or cost.

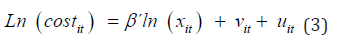

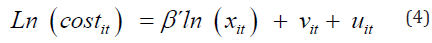

The stochastic frontier consists of

(i) a deterministic component,

(ii) a stochastic component representing random error in

the estimation of the frontier, and

(iii) an inefficiency component for each company. It is

calculated, in most studies, using an input-oriented Cobb-

Douglas functional form with stacked data, as in Equation 3.

The SFA model allows the error to be disaggregated into two

independent components, vit and uit, and to be uncorrelated with

the explanatory variables [26].

The component vit is random noise that represents deviations

of the deterministic component from the frontier due to the

non-inclusion of an explanatory variable or measurement error.

We adopt the assumption that the error vit is independent and

identically distributed and normally distributed with a zero mean

and constant variance. This error term has all the characteristics

of the error term used in the classical linear regression model.

The uit component is a positive error term that reflects

the cost inefficiency of firms. This term indicates the cost

excess relative to the stochastic frontier. When this component

is null, the firm is at the efficiency frontier. Aigner, Lovell, and

Schmidt [24] propose using the half-normal distribution as the

probability distribution for this term, as in Equation 4:

This model is referred to as SFA-ALS. Even today, this is the

most common specification used in SFA models found in the

literature. Subsequently, other distributions have been proposed

for the u term, the most common of which are the exponential,

normal truncated, and gamma distributions [26].

Methodology

Choice of variables

The choice of inputs and outputs is a crucial aspect of

benchmarking methods, especially for DEA, as the discriminatory

power of these methods decreases as the number of variables

increases [27]. Therefore, a researcher needs to be parsimonious

in choosing variables, opting for those that best describe the

evaluated process.

There is no consensus on the best variables to describe

the electricity distribution process. Jamasb and Pollitt [13]

investigate the most frequently used variables in benchmarking

studies. Among inputs, the following stand out: operating costs,

number of employees, transformer capacity, and network

extension. With regard to outputs, distributed energy and the

number of consumers are the most common choices.

This study uses monetary and physical variables that are

widely adopted in benchmarking studies as well as non-technical

losses and service quality indicators. The monetary variables

are operating and total costs. The physical variables are the

same as those adopted by the Brazilian regulator in the current

tariff cycle, namely, the underground network, the over ground

network, the high-voltage network, distributed energy, and the

number of consumers. Non-technical losses and the service

quality indicators are also the same as those adopted by the

Brazilian regulator that consider the difference between actual

and expected values [18].

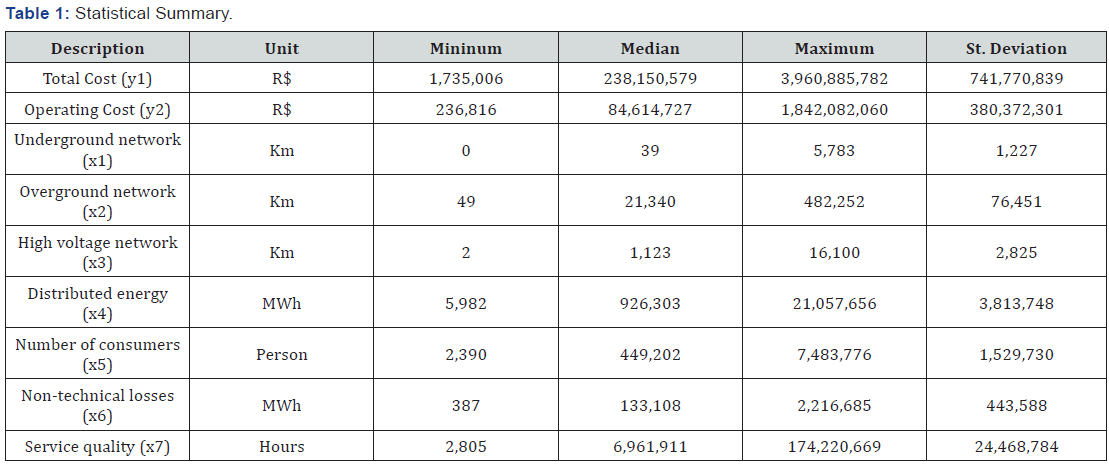

Data

An efficiency analysis is conducted using data from 60

Brazilian DSOs from 2008 to 2012. The dataset can be found at

the website of the Brazilian regulator (www.aneel.gov.br) and

was divided into two periods: 2008 to 2010 for the efficiency

frontier calculation and 2011 to 2012 for the model validation.

The methodology used to calculate capital costs was the

same as that used by the regulator in Technical Note 185/2014

from the Economic Regulation Superintendence [18]. Operating

costs and outputs were the same as those from Technical Note

66/2015 from the Economic Regulation Superintendence

database [11]. Table 1 shows sample descriptive statistics.

This data shows great variability between companies,

especially for underground networks, which are only found in

the capitals of large countries.

Models

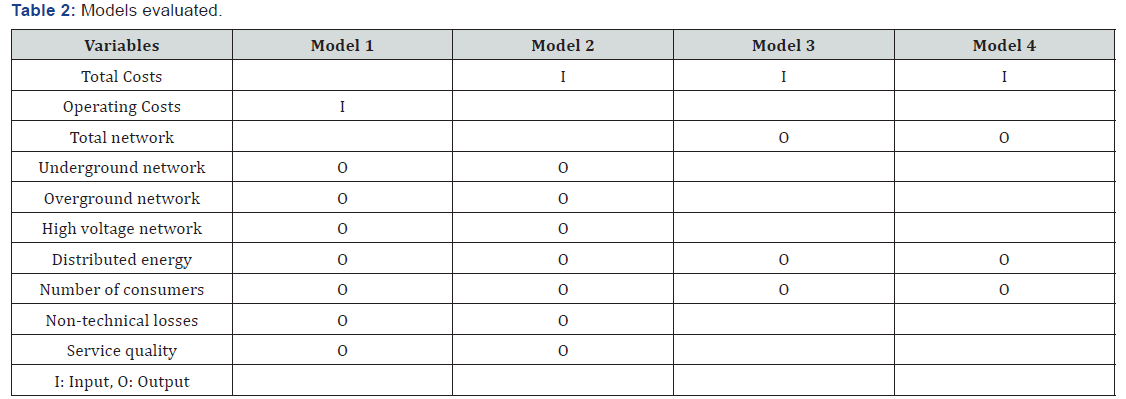

Four distinct models are evaluated in Table 2: three DEA

models and one SFA model. The first two models were selected

to evaluate the impact of total costs on efficiency analysis. This

choice was based on the literature review presented in Section

3. The last two models were included in the analysis to validate

the DEA results using SFA, a guideline recommended by Bogetoft

and Otto [28].

Results

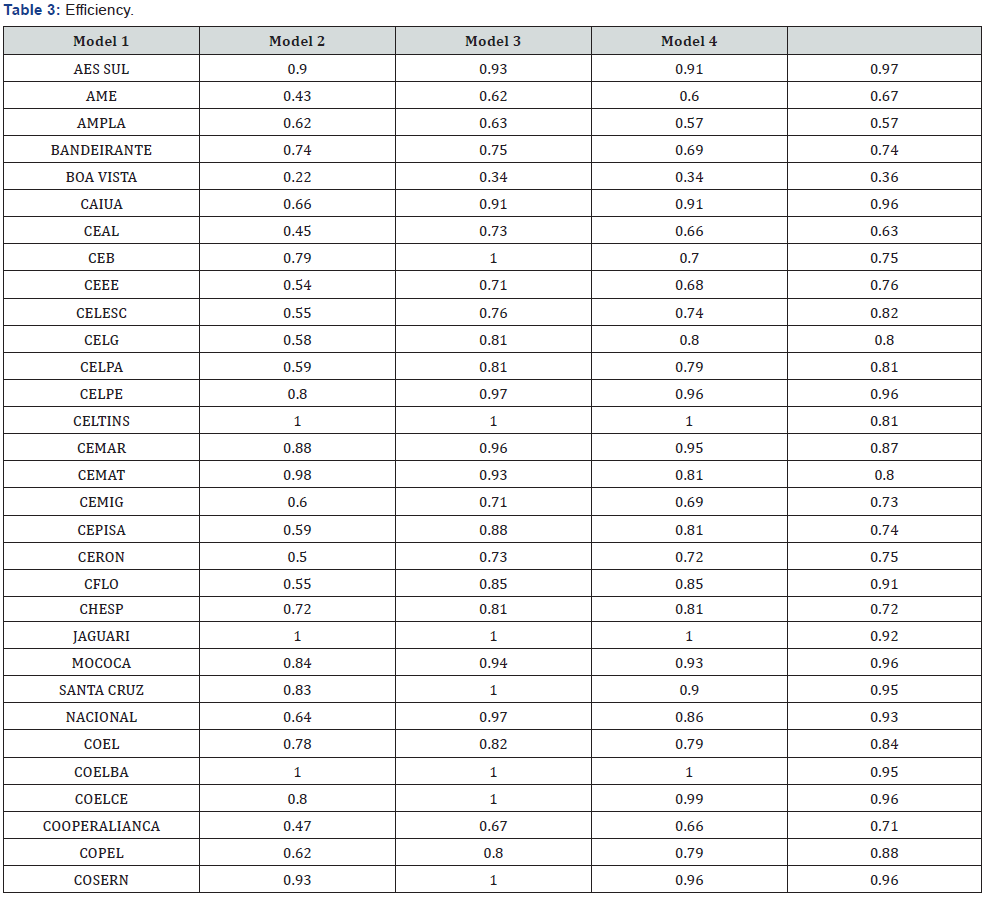

The proposed methodology was applied to the four models

defined in Section 5.3 using data from sixty Brazilian DSOs from

2008 to 2010. Models 1, 2, and 3 were based on DEA using an

input orientation and non-decreasing returns to scale. Model

4 applied SFA and was estimated using an input-oriented cost

function. Table 3,4 shows the estimated results.

The results indicate that DSOs have average efficiency scores

of 0.70, 0.84, 0.80, and 0.81 in Models 1, 2, 3, and 4, respectively,

which indicates room for improvement.

Model 1 considers ten utilities as efficient, including three

small and seven large companies. Two of them, Eletropaulo

and Light, are located in high consumer density areas. Others that have reached the frontier do not have such high densities,

which implies relatively efficient input management. Other

utilities have an average efficiency of 0.67. This inefficiency can

be explained by low load densities and dispersed consumers,

which make such areas expensive and challenging for energy

distribution. Three CPFL Energia DSOs are considered efficient:

Piratininga, CPFL Paulista, and RGE. These results suggest a

possible advantage associated with holding characteristics,

as Semolini [29] also concludes. Twenty-nine utilities have

efficiency scores under 0.67, including AME, Ene. Paraíba, Ene.

Sergipe, CEMIG, and CEEE. The first three are located in the

Brazilian north or northeast, which are characterized as less

urbanized regions with the lowest monthly income [30]. Analysis

indicates that these companies should reduce operating costs by

55% on average.

Model 2, which considers total costs as inputs, indicates

lower efficiency levels for three DSOs (Piratininga, CPFL

Paulista, and Light). New companies are considered efficient,

such as, for example, CEB, Coelce, and Cosern. Comparatively,

these companies have partial productivities that are higher than

their segment averages, especially for total costs and the highvoltage

network ratio. Therefore, some companies’ efficiencies

decrease under Model 2, whereas those of others increase, and

the segment average efficiency rises from 0.70 to 0.84. The

efficiency scores have a correlation of 0.76 with those of Model

1. Light is located at the efficiency frontier in Model 1. However,

with total costs, the DSO receives a score of 0.90; a reduction of

10% in its efficiency. On the other hand, Cepisa achieves better

results. Under Model 1, it has an efficiency of 0.59 compared

to Celtins, Coelba, and João Cesa. Under Model 2, the company

obtains a score of 0.88, and its peers are Celtins and Coelba. This

evidence indicates that Model 1 can penalise companies that are

efficient in total costs and can favour those that are efficient in

operating costs.

Model 1 can distort the incentives given to companies. For

example, Coelce obtains an efficiency of 0.80 in Model 1 and

of 1.00 in Model 2. These results corroborate the existence

of a possible trade-off between operating and capital costs.

Therefore, models with total costs are more appropriate for

efficiency analysis [1]. In fact, Model 1 does not capture the

aspect of DSOs’ total costs.

In contrast with the previous models, Model 3 considers

only seven companies to be efficient. CEB, Coelce, and Cosern

have lower scores following the changes to the model, such as

the exclusion of service quality and non-technical losses and the

aggregation of the distribution network. Some companies, such

as Coelba and RGE, remain on the frontier in all three models.

The results of Model 3 results have a 0.89 correlation with those

of Model 2. In addition, the efficiency of Light is considerably

lower in Model 3, with a value of only 0.61. The company

obtained scores of 1.00 and 0.90 in Models 1 and 2, respectively.

This change can be explained by inclusion of the non-technical

loss variable, given that difference between the expected and

real values is minimal.

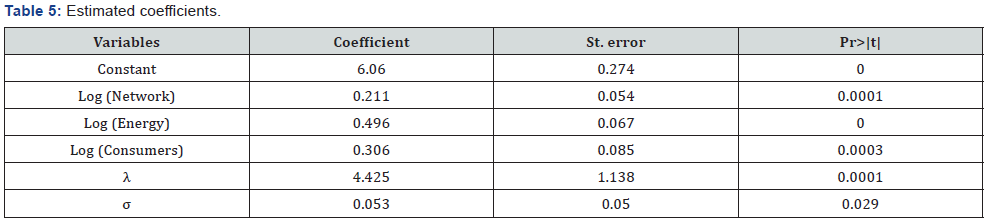

Model 4 estimates efficiency using SFA and estimates the cost

function using the Cobb-Douglas functional form. An exponential

probability distribution is used to estimate the inefficiency term

of the u error. The coefficient on the logarithm of the products is

shown in Table 5.

Table 5 shows that all estimates of the product coefficients

are significant at the 5% level. The significance of the variance

parameters of the error components, σ and λ, validate the

use of the SFA stochastic model. We observe that the most

important product is the distributed energy, which has an

importance of almost 50% between the three products. The

sum of the coefficients of the three products is 1.01, indicating

the possibility of constant returns to scale. The results of the

application of this model have a 0.76 correlation with those of

Model 3, since Model 3 is constructed using the same inputs and

products as this model is.

Of the sixty DSOs, thirteen companies have efficiencies

greater than 0.95, and only two companies have efficiencies

less than 0.5. Of these two DSOs, one is João Cesa, with a score

of 0.45, but in Models 1, 2, and 3, this company is considered

a benchmark. This company has the smallest outputs in the

sample, and this fact may be distorting its efficiency.

Discussion

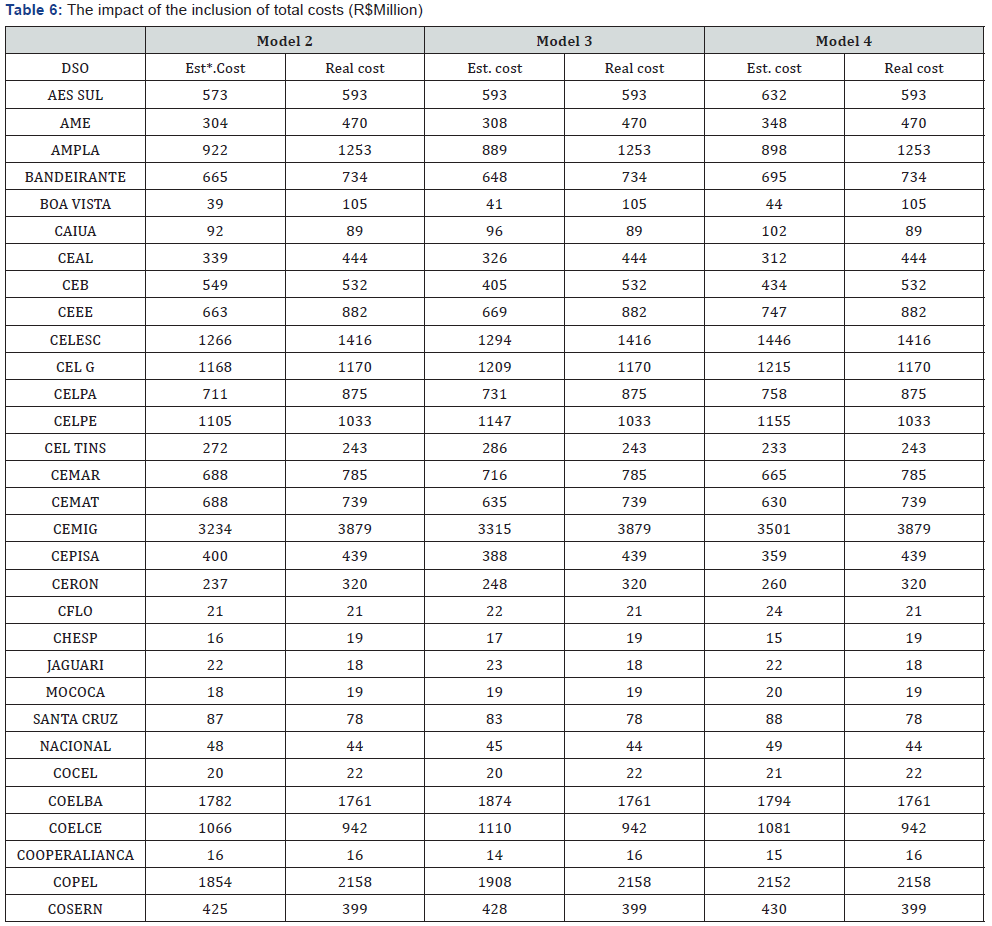

To analyses the economic impacts of the different models, we

calculate:

(1) the average segment efficiency for each model,

(2) each distributor’s score divided by the average segment

efficiency,

(3) the product of the previous result and the average real

total cost from 2008 to 2010, and

(4) the comparison of the previous result with the average

real total cost from 2011 to 2012. The results can be seen in

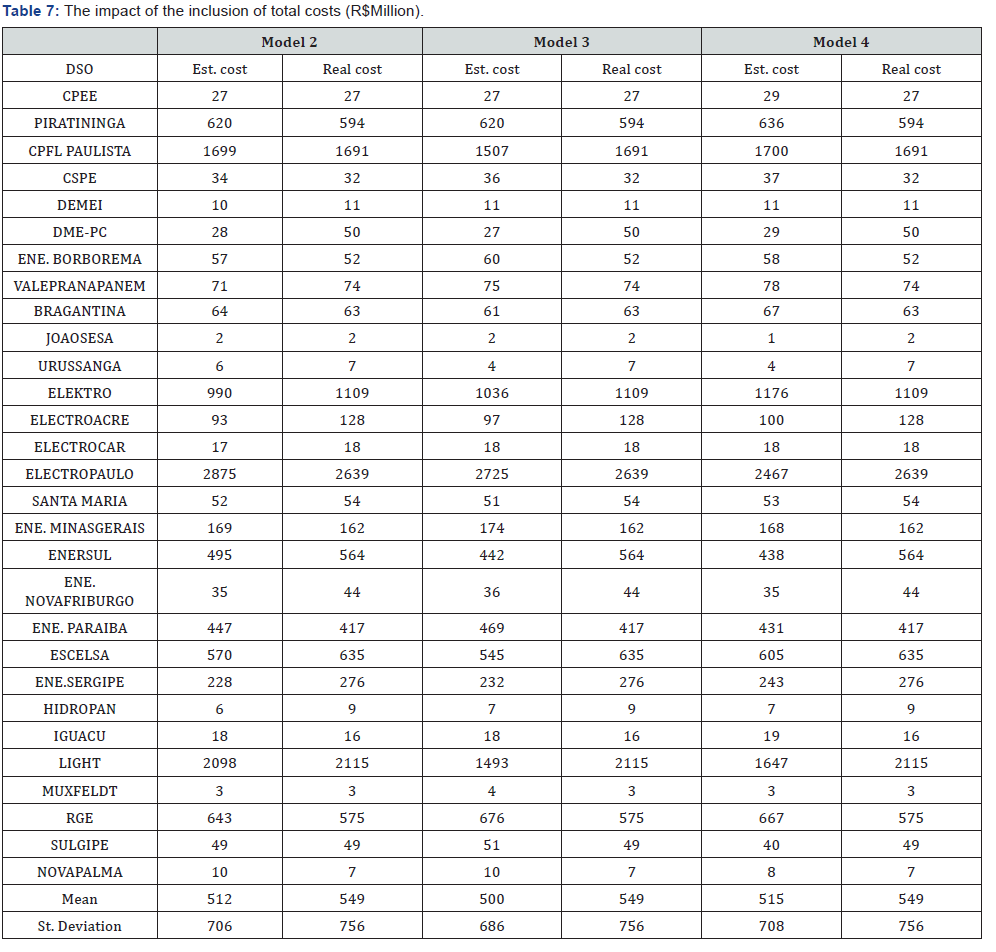

Table 6,7.

Comparing the total costs estimated by Model 2 and the real

values, we find a necessary average reduction of R$37 million,

which is approximately 7% of real total costs. A similar result

was found by Yu, Jamasb, and Pollitt [29], who analyse the

efficiency of twelve English DSOs from 1995 to 2003. Of the

sixty companies evaluated, thirty-three exhibit total costs that

are higher than those defined by DEA. According to Model 2,

AME needs to reduce cost by R$166 million or, in percentage

terms, 35% of its total costs. Another inefficient large company

is Ampla, which spends R$331 million more relative to others.

Other DSOs have lower real total costs; RGE is a member of this

group, with a real total cost of R$575 million versus an expected

cost of R$643 million.

Coelce also uses comparatively fewer inputs, about 12%

fewer than expected. Some companies have real and expected

values that are very close, requiring no decrease or increase.

These companies include Coelba, CPFL Paulista, and Light.

Model 3 suggests an average reduction of R$49 million, or

approximately 9% of real total costs. Giannakis et al. [1] make

a similar diagnosis when evaluating UK utilities between 1991

and 1999. About half of companies need to reduce their costs.

This model does not include the quality and non-technical

losses variables, as in other studies [1,14,29-33,]. AME remains

inefficient, needing to reduce costs by R$162 million, which is

R$4 million less than in Model 2. Ampla needs to reduce costs by

R$364 million. As in the previous model, some utilities prove to

be efficient, such as, for example, RGE, which spent R$100 million

less than expected. Coelce maintains its good performance in

this model, and AES Sul has an appropriate level of total costs.

Model 4 presents the lowest required cost reduction, with a

value of approximately R$34 million, or 6% of costs. This result

is to be expected since SFA considers data error. This model

does not include environmental variables since they were not

significant. These results corroborate previous work, such as

that by Yu et al. [29], who conclude that environmental factors

do not have significant economic or statistical impacts on the

overall performances of English DSOs. The model finds the

sharpest reductions with respect to Boa Vista (58%) and João

Cesa (51%). In the previous models, the latter is considered

efficient, with opportunities to increase total costs by 3% and

8%, respectively, in Models 2 and 3. Another utility with a similar

result is Eletropaulo, which can increase total costs by R$236

million in Model 2, can increase them by R$86 million in Model

3, and should reduce costs by R$172 million in Model 4. Elektro

moved in the opposite direction, as it is evaluated positively by

Model 4 but needs improvement in Models 2 and 3.

Finally, when analyzing the results of all models, we find that,

in average percentage terms, the total costs estimated by the

benchmarking methods are not considerably smaller than those

defined by the Brazilian regulator.

Conclusion

Efficiency analysis is receiving considerable attention from

regulators in the electricity sector, especially in the distribution

segment. Due to the natural monopoly characteristics of the

electricity distribution process, utilities are not subject to market

forces.

This study simulated a virtual competitive scenario among

Brazilian utilities. DEA and SFA were used for efficiency analysis.

Both methods calculate an efficiency frontier based on the

evaluated company’s inputs and outputs to evaluate the impact

of total costs.

The novelty of this study is in the use of total costs as inputs

in efficiency models, specifically in the Brazilian case. Although

total costs have already been evaluated by other studies, mainly

in European countries, they have not been applied in a country

with a considerable distribution segment growth rate, such as

Brazil.

Four different models were studied. Comparing Model 1

and Model 2 allowed us to evaluate the impact of total costs

on efficiency, whereas the comparison between Model 3 and

Model 4 was useful to understand the robustness of the results.

In the first comparison, 88% of utilities had a higher efficiency

score in Model 2, with a mean difference of 0.14. In the second

comparison, the efficiencies of 39 companies increased with SFA,

with a correlation between the results of 0.76.

When evaluating the impact of the use of incentive

regulations in total costs, we find that DSOs need to reduce their

costs by an average of R$ 40 million per year, which is around 7%

of total costs. This efficiency gain will affect consumers, who will

pay lower tariffs.

This study evaluated the efficiency of Brazilian DSOs using

total costs as an input; future studies could focus on superefficient

Brazilian companies.

For more articles in Open Access Journal of

Engineering Technology please click on:

Comments

Post a Comment